The Weekend Leverage

Venture Capital’s disrupted, crypto’s corrupted, and my Timberwolves bracket’s busted.

I can’t stop thinking about Tom Cruise. With the release of the final Mission Impossible film, I’ve gone full Cruise-groupie watching interviews from over the course of his career. What makes the MI films special isn’t actually the movies themselves—though many of them are wonderful. It’s watching the behind-the-scenes, learning about Tom Cruise’s insane risk tolerance, skill, and devotion to delighting audiences. This is my pro-tip for how to best appreciate how great Mission Impossible really is.

For this final installment, I loved learning that he was simultaneously operating a bi-plane 10,000 feet above South Africa, controlling the camera’s focus with one hand, and adjusting the plane’s angle with the other, so the lighting hits just right as he pulls off stunts. It is the single greatest action sequence in cinema history.

Photo credit: Mission Impossible, The Final Reckoning

There’s something in Tom Cruise process lesson—too many startups focus on final polish without bringing customers along on the journey of building the company. That’s why this week I publicly released an investor update so all the readers of this newsletter can understand the amount of work and care I’m putting into this.

We’ll get to that. But first, today’s issue is brought to you by Mercury.

This week, I endured the painful ritual of sorting out expenses—new hardware for my home office, software subscriptions, chatbots, and the list goes on. The only thing worse would have been managing stacks of paper receipts without earning any rewards. Thankfully, Mercury has my back with a credit card that offers 1.5% cashback and effortless expense tracking automation. Because, let's face it, time is money—and so is that sweet 1.5% cash back. If you're looking for a banking product that's genuinely delightful to use, give Mercury a try here.

(Mercury is a financial technology company, not a bank. Banking services provided through Choice Financial Group, Column N.A., and Evolve Bank & Trust; Members FDIC. The IO Card is issued by Patriot Bank, Member FDIC, pursuant to a license from Mastercard®. To receive cash back, your Mercury accounts must be open and in good standing, meaning they cannot be suspended, restricted, past due, or otherwise in default.)

MY RESEARCH

Why aren’t AI agents working yet? The release of Claude 4 highlighted instances of the model attempting blackmail, stealing its own code, and escaping its creators, all in the name of self-preservation. These modes of failure instruct close followers why AI agents aren’t working yet. I’ve invented a new framework ($) that I call the “legibility index” that I think helps us to understand what happens next.

The Leverage is only sort of working. I’ve been thinking about the business totally wrong. The short of it: Craft drives growth, insights improve retention, and neither of those drive paid conversions. Over 34,000 of you are reading, which is a really incredible start. But for this thing to exist in the long-run, there are multiple things I need to fix, including top of funnel, the addition of video products, and more clearly explaining the benefits of going paid. To start you can expect two paywalled pieces per week going forward with more changes to come. Thanks for a wonderful first month! You can read more detailed analysis and reflections here.

THE BIG THREE STORIES

Billion dollar check, no equity required. This week Grammarly announced that they had raised $1 billion from the venture capital firm General Catalyst. The capital came from its “Consumer Value Fund,” which companies can tap into as a loan to fund sales and marketing expenses. No equity sale required, just good, old-fashioned debt financing. Three years ago I argued that “venture capital is ripe for disruption.” Well, it happened. Told ya.

The firms at the top of the pile, like General Catalyst, Sequoia, and others, are able to offer a suite of products and services to entrepreneurs that boutique firms can’t even hope to mimic. Beyond products like these loans, they’ve also pushed into seed in a large way with accelerators, generous funding terms, and even personal banking for their founders.

I talked with Bryce Roberts, founder of the venture capital fund Indie, about this. He believes that “the asset gatherers have already disrupted venture. It’s their game now. They’ve gotten better at going earlier faster than the classic venture firms have gotten at competing with them.” [emphasis added]

The downstream effects of this on innovation are underdiscussed. The positive view is that this much capital and all these services will allow founders to go after more scientifically ambitious ideas, but much remains to be seen. If you have an opinion on this, I would love to chat.

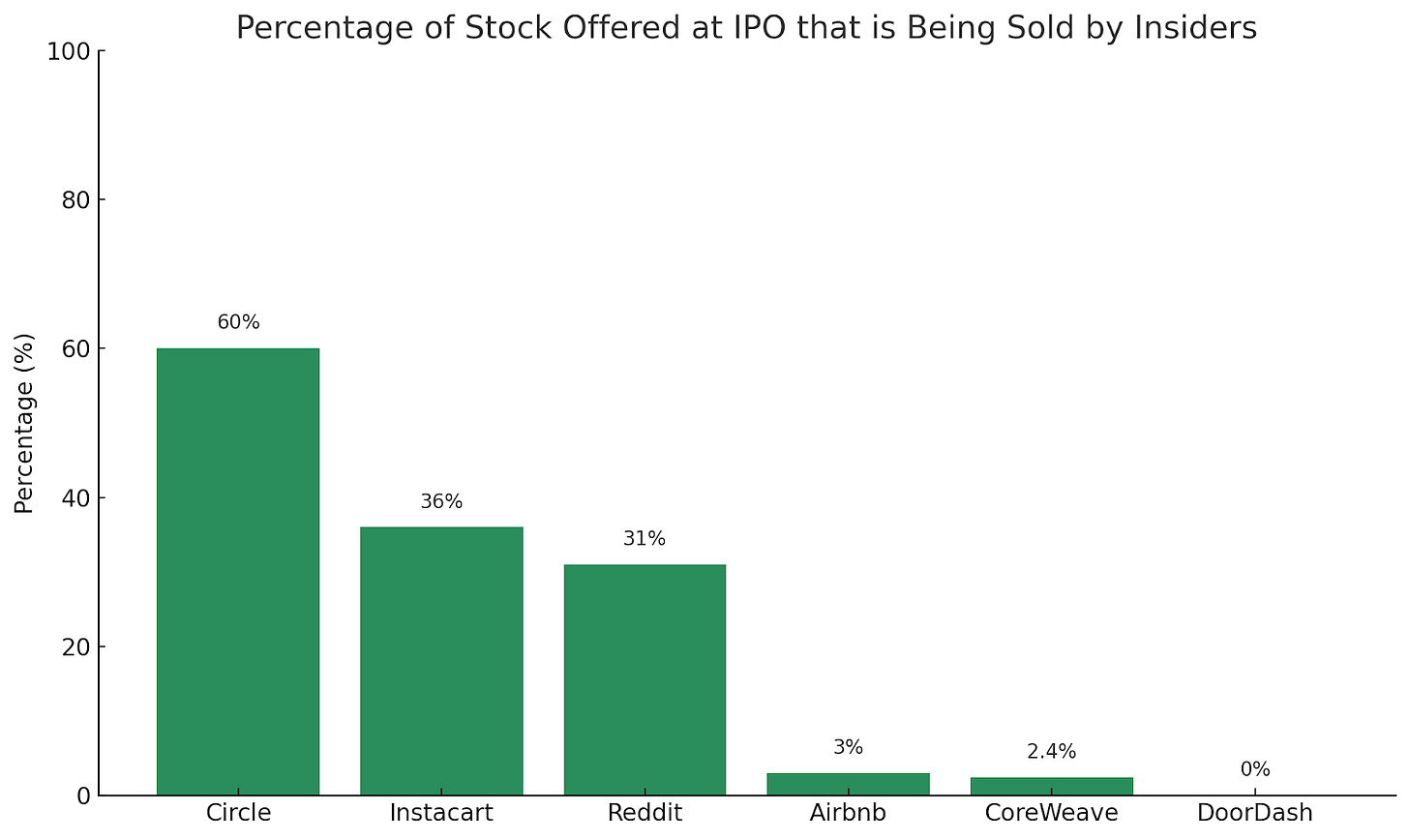

If Stablecoins are good, why does their IPO suck? As I’ve previously written about ($), I’m a big fan of stablecoins. It's the first crypto use case that I can wholeheartedly get behind. This week though, news broke that made me doubt myself. Circle, the issuer of the USDC, a stablecoin pegged to the U.S. dollar, filed their S-1 in anticipation of going public. However, insiders at the company like executives and investors, are selling an incredible amount of stock. Inside stock represents 60% of the pool up for offer, which is the highest that I can remember in the last 10 years of tech. For comparison, look at some notable companies over the last few years.

If my thesis around Stablecoins is right, why on earth are so many insiders selling? They are the people who know the company best, what do they know about the market that I don’t? This is one I would have considered buying, but now I’m having second thoughts.

A $77 billion data center. A few weeks ago I warned you of the importance of the Gulf States to AI. This week an interview in the Financial Times confirmed that. In it, Humain, the Saudi Arabian state-owned AI company, discussed launching a $10 billion venture fund in conjunction with a massive data-center complex that will cost a staggering $77 billion once it is completed. It is planning to design chips, build data centers, train models, run other people’s models, and develop AI applications. It is a level of ambition that costs hundreds of billions to execute on. This is Manhattan Project levels of spend, with state capacity being fully turned toward winning the AI race.

VISUAL SIGNAL

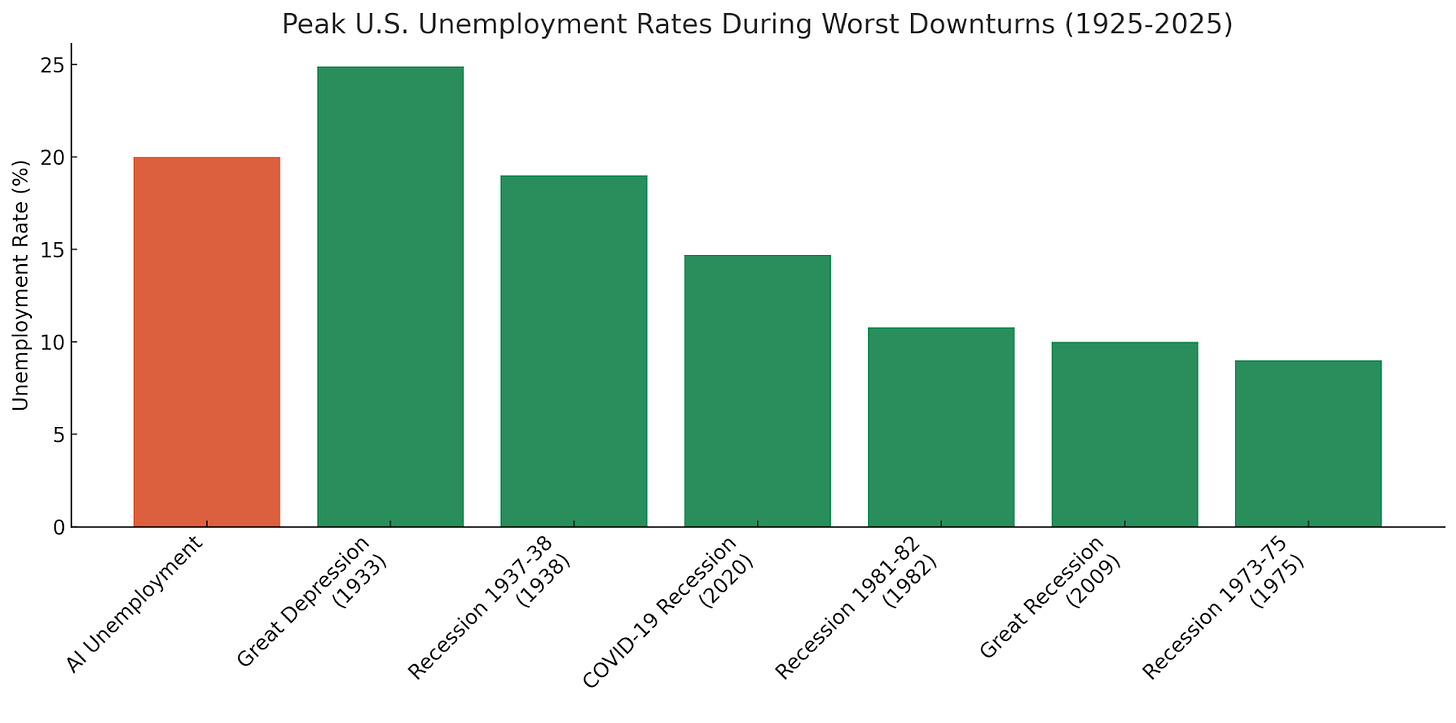

Anthropic’s CEO says doomsday is coming. At what point should we take these AI labs seriously? Here’s the quote that made my butt cheeks clench in fear, “AI could wipe out half of all entry-level white-collar jobs—and spike unemployment to 10-20% in the next one to five years.”

An unemployment rate of 20% is an economic catastrophe. For comparison, look at the projected AI unemployment rate compared to previous depressions and recessions.

This is a level of economic disruption that would bring about violence, societal upheaval, and total disillusionment of America’s youth. Dario Amodei, Anthropic’s CEO, is saying this could happen next year. Now, I seriously doubt that change could happen so quickly. Technology adoption takes time. Still, it is worth actively hedging against a world where so much of knowledge work becomes automated. How are you preparing?

TASTEMAKER

That was some heavy ass news, so here are some palate cleansers I’ve enjoyed recently.

Frieren: Beyond Journey's End: Most anime today are about a dude slowly gaining power so he can beat up the bad guy in the last episode. Frieren is about what comes after that. What do you do now that the villain is defeated? How do you grieve the friends you lost along your journey? It is a meditative, peaceful reflection on the question of mortality and how, or if, we can move on. I’m not a huge anime guy, but this one honestly got me a little teary-eyed. It’s on Netflix if you are in North America.

The Dialectic Podcast: This has been my new favorite podcast lately. The host Jackson has great taste in guests and asks deeply thoughtful, well-researched questions. If you are one of those “Silicon Valley should be the intersection of liberal arts and technology” people, this pod finally scratches that itch. I recommend the episode with Alex Danco discussing the necessity of gift culture in innovation.

340 slides from Mary Meeker: I’ve been reading Mary Meeker’s presentations for as long as I’ve been working in startups, and her latest on AI may be her best ever. She takes an extensive (and expansive) view on whether AI is actually working. If you enjoy charts and data like me, it's a fun read.

Fall Out Boy Forever: An essay I can’t escape. Tragic and triumphant, this work is all that writing can be. Pour the beverage of your choice and settle in for the most beautiful 15 minutes of your entire week. I also highly recommend the author, Hanif Abdurraqib, not just because he is also a die-hard fan of my beloved Minnesota Timberwolves. His book They Can’t Kill Us Until They Kill Us is one of my favorite anthologies of all time.

Until next week my friends. Paid subscribers to The Leverage can look forward to two paywalled essays this week containing my best and most in-depth research.

If AI tools can already assist with writing, why is Grammarly still important, and what makes it attractive to investors?